Frequently Asked Questions

- general

- Coverage & Rates

- Eligibility

- Getting Started

- payment & Claims

- Admin & Other Insurance

- COVID-19

What does my provincial health insurance cover?

Provincial health plans differ between provinces. However, while doctors visits and in-hospital care are covered the following are typically excluded:

- Prescription drugs

- Dental care

- Medical supplies / equipment

- Professional practitioners such as physical therapists, psychologists, speech therapists

- Private and semi-private hospital

- Hearing aids

- Emergency travel medical care

- Homecare and nursing

- Vision care

Why should I get health insurance if I'm healthy?

When we’re young and healthy we feel invincible so it’s easy to put off applying for insurance. In reality, even if you’re not spending much now, when you’re healthy is the best time to sign up for health insurance. In fact, it’s the only time you’re guaranteed to get the lowest rates and that you will be covered if anything happens in the future. If you become ill or injured and then try to apply for the coverage you need, you may no longer qualify at all. Or, your monthly premiums will be much higher, often for much lower levels of coverage.

What is the difference between 'Medically Underwritten' and 'Guaranteed Acceptance'?

Medically Underwritten refers to plans that ask health questions during the application process. Often a simple questionnaire, these questions are used by the insurer to gauge your health at the time of application and reduce the risk of large claims to the plan. As a result, these plans are able to provide better coverage for lower rates.

Guaranteed Acceptance plans do not ask any medical questions and offer coverage regardless of health history. They can be a good option for people with ongoing high drug expenses or a serious health issue. However, they typically have limited coverage and cost more. If you're healthy these plans will not be the best value.

Health Plus PRIORITY and OPTIMUM plans are medically underwritten. As a broker we also sell guaranteed acceptance plans from other insurers. Learn more about Medically Underwritten vs. Guaranteed Acceptance or reach out to us for help finding out what the right fit is for you.

How do I know what my Health Plus plan covers?

The Coverage & Rates sections on our website provides detail on both the Optimum and Priority options. If you have any questions the charts don’t answer, don’t hesitate to get in touch.

When you become a Health Plus™ client, you will receive a detailed benefits booklet that explains all aspects of your coverage, how your claims are paid, how to submit a claim, and other useful info.

Can I sign up for just dental, travel, or drug coverage?

No. We designed Health Plus to be a comprehensive plan for people without coverage through an employer. As such it is a package deal, but the best package you’ll find. However, if you already have some coverage through an employer or partner and don’t need a full benefits plan we’d be happy to look into other options for you. We’re a full-service broker with access to health insurance plans from all the top insurers.

Can I top up one of my benefits?

You can’t directly add more coverage to your Health Plus plan. However, if you do exceed your maximum coverage levels our Cost-Plus feature allows you to put additional expenses through the plan tax-free. Ask us how this can work for you.

How do maximums work?

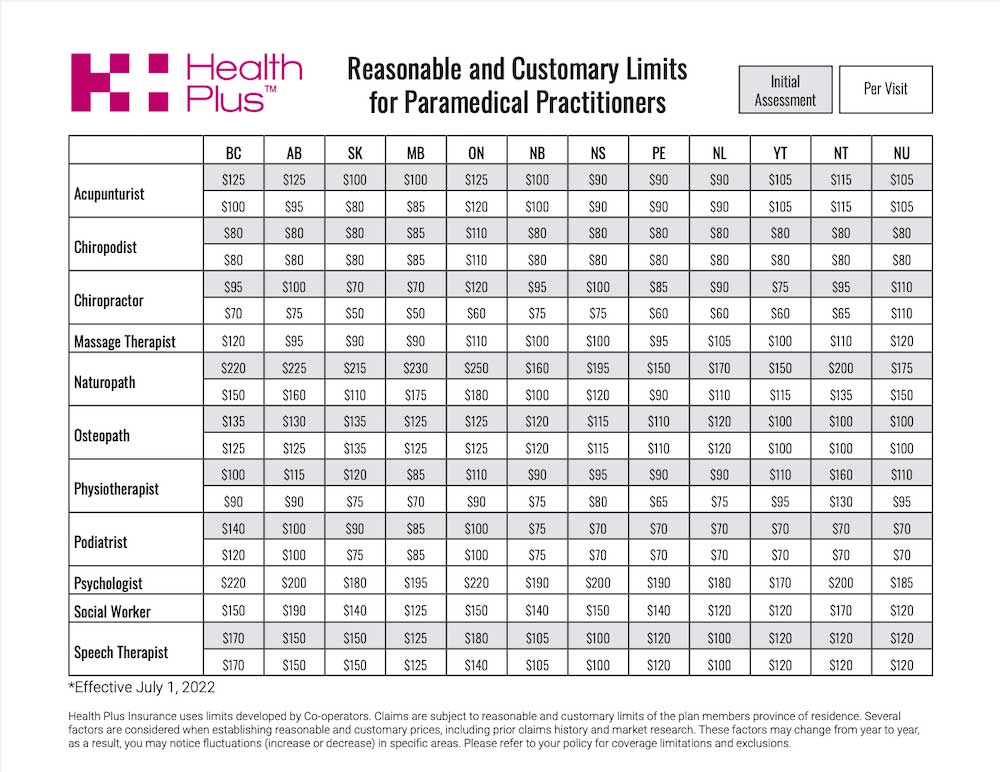

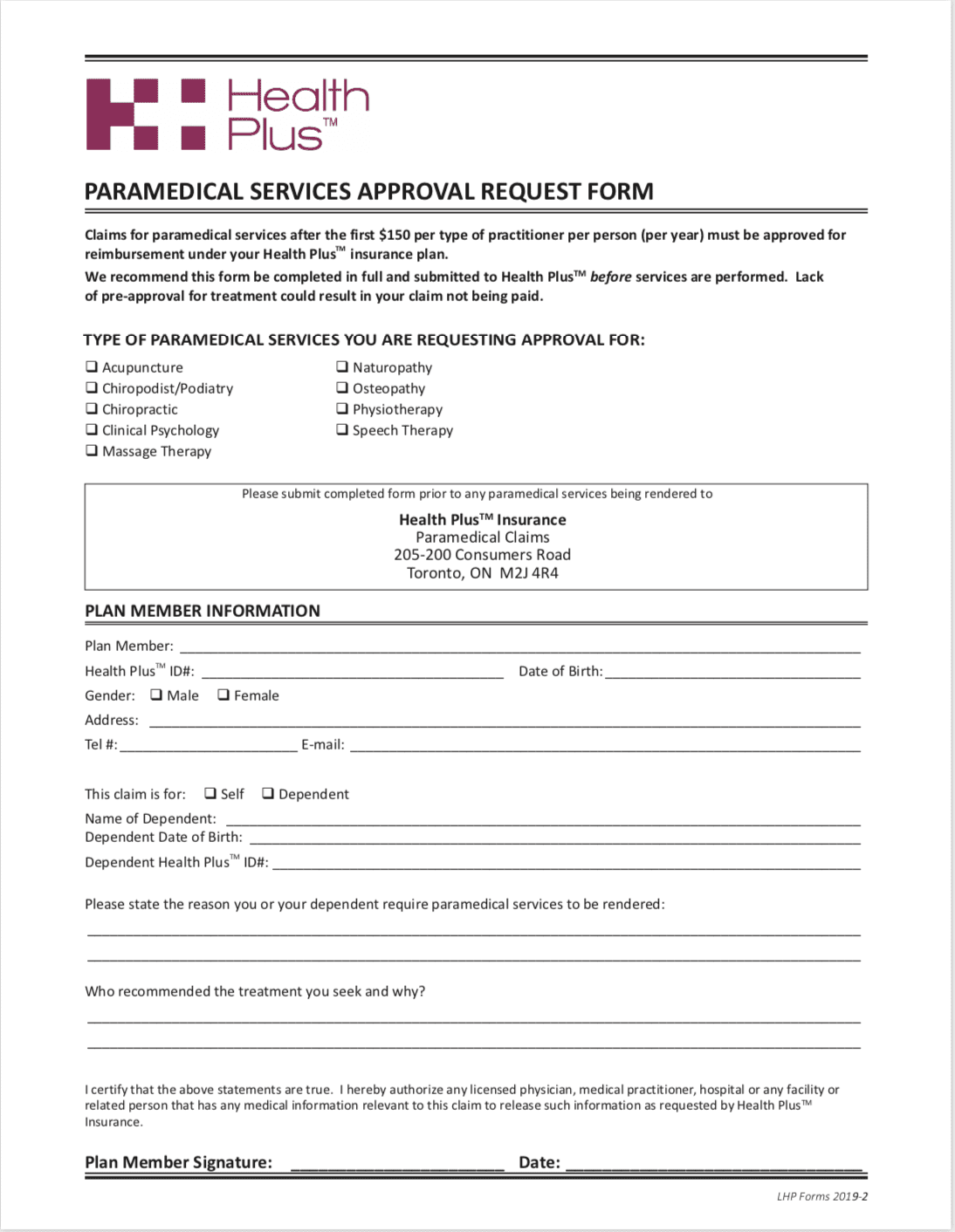

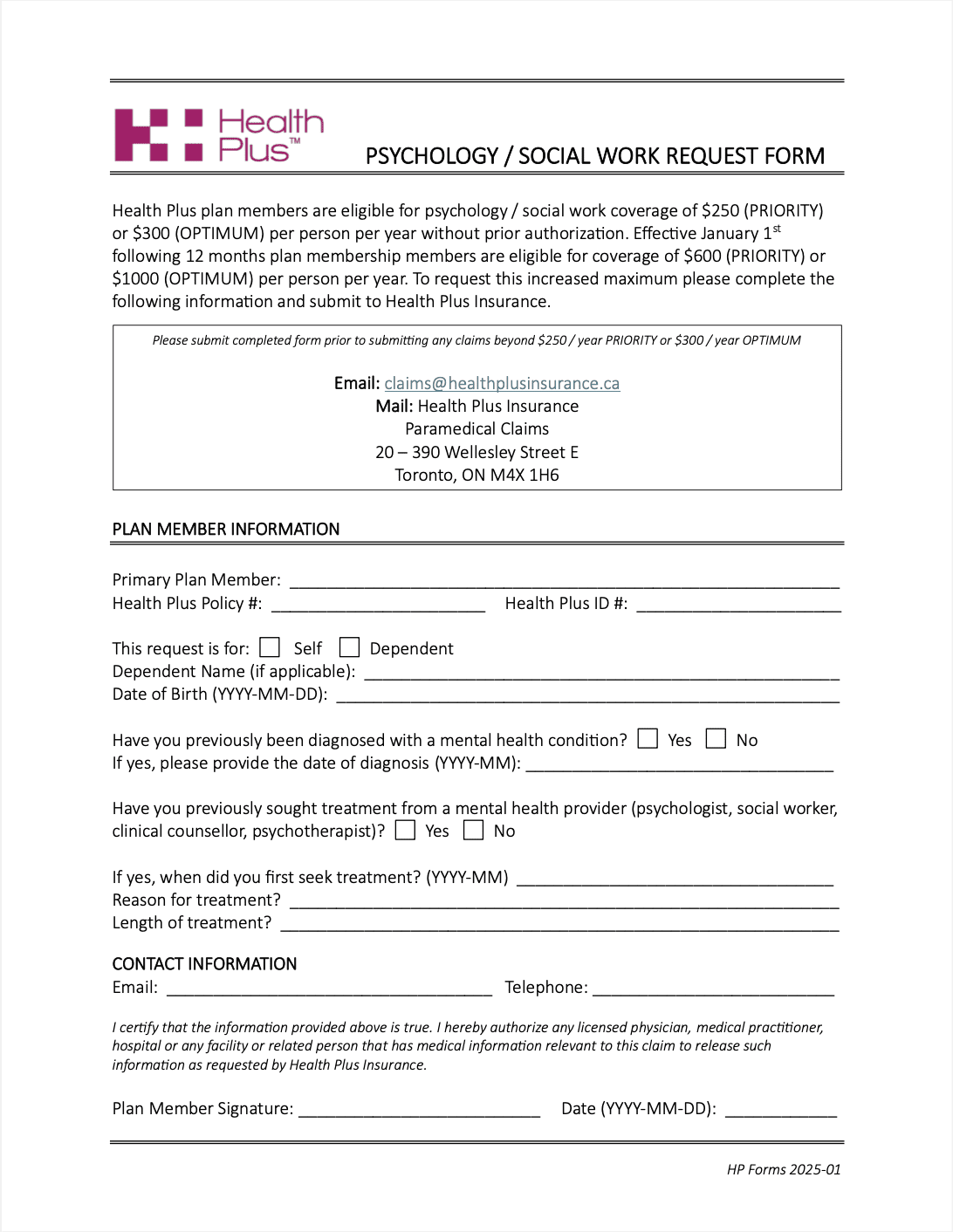

All annual maximums (e.g. $30 000 drugs, $600/$1000 paramedical) are set on a calendar year, which means they start January 1 and end December 31st. Certain services have a different type of limit, for example dental or vision exams, every 9 or 24 months respectively, measured from the time of service.

How do I qualify for Health Plus?

Health Plus PRIORITY and OPTIMUM plans are available to anyone living in Canada (excluding Quebec) who is working. If you're retired, ask us about our retiree option. You can apply up to age 75. Plans are medically underwritten, meaning a medical questionnaire is required. You must be in generally good health to qualify.

As a full-service broker we also offer plans from other insurance companies, including guaranteed acceptance plans. Eligibility for these plans varies. We are always happy to review your options with you.

What if I am taking prescription drugs now ... is Health Plus available for me?

Yes. You may still qualify. Depending on the condition and the medication, an increased monthly rate may apply that takes into account the cost of your medication. Unlike other plans, we do not automatically exclude treatment for existing conditions. We’d be glad to review your individual situation and give you a prompt answer and quote.

Can I qualify for Health Plus if I am not a Canadian citizen?

Yes. If you are covered under your provincial plan (such as OHIP in Ontario) or have equivalent insurance, you are eligible for Health Plus™. If you don't have equivalent insurance, we can arrange it for you.

I am not a small business owner. Am I eligible for Health Plus?

Yes. Health Plus™ was designed for workers who do not have benefits through an employer. Our clients are contract workers, freelancers, independent professionals and entrepreneurs, and even students, as well as small business owners.

What constitutes a pre-existing condition? How do I know if I qualify if I have a chronic illness or other health concern?

The best way to know if you qualify is to call us or fill out an application (no commitment required). Some conditions may not affect your coverage at all, while some may disqualify you from the plan. It also may depend on how recent or well-managed your condition is. We’re happy to review your individual case and if you do not qualify, can go over alternative options with you.

How do I enrol in Health Plus?

Enrollment is simple and prompt. Complete, sign and send us your Application (Click here to apply online). We review it within a few days to confirm you qualify and contact you with approval. You will receive your drug card by mail and a complete Health Plus information package by email with coverage details, claims forms, and key phone numbers.

When will my coverage start?

Your Health Plus insurance becomes effective on the first day of the month following approval of your Application. Your pre-authorized monthly payment is processed on the first of each month.

What if my circumstances change and I no longer need Health Plus?

While Health Plus is portable, meaning you can take it with you no matter where you work, we understand circumstances change. You may receive benefits through an employer or partner and no longer need Health Plus. It’s simple to cancel.

To discontinue coverage, you must notify us by email or by letter 30 days in advance. Terminations are effective the first of the month.

For example: to stop coverage as of June 1st you must notify us by May 1st.

When will I receive my Welcome Kit?

Once your application has been approved, we will contact you to let you know. You will receive your Welcome Kit by email within 1 week. Your Health Plus ID card, including your ID number and temporary password for the MDM online claims portal, will be sent by mail within 3-4 weeks. Any eligible expenses during that time period (following the first of the month or alternate agreed upon start date) can be claimed once you receive your ID card. Should you need your ID number in advance, give us a call.

How does Health Plus pay my bills?

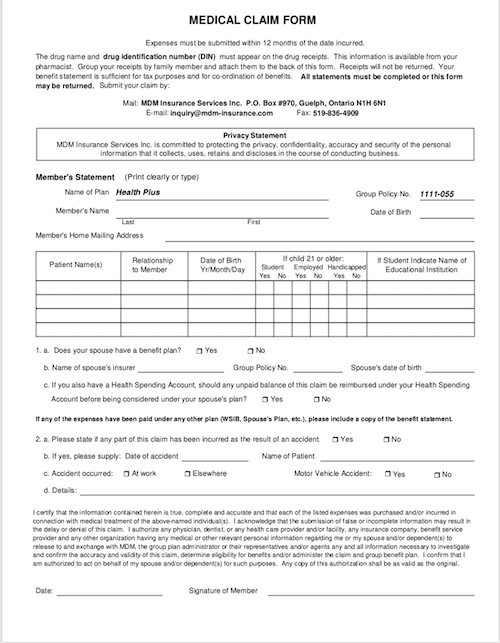

Prescriptions are paid for automatically at the drug store with the Health Plus card you receive with your Welcome Kit when you enrol. Claims for all services except travel are submitted either online or by mail / e-mail to MDM Insurance. For dental bills, the dentist will submit the claim on your behalf and you will be reimbursed by MDM Insurance. Read How to Claim for full details. A Medical Claim Form is available in your online claims portal and in the Resources section on our website.

How do I sign up for online claims?

Using your personal Access ID (your Health Plus ID number) and temporary password provided in your Welcome Letter you can register on mdm-insurance.ca. Submit your online banking information to receive direct deposit for claims.

What is the MDM Mobile App?

The MDM Mobile App, available for download through the App Store or on Google Play allows you to submit claims, and view your claims history and coverage information directly from your mobile device. Log in using your personal Access ID (Health Plus ID number) and the same password you use for the Online Claims Portal.

How long will it take to process a claim?

Online claims are typically processed within 3 business days and can be paid by direct deposit once you sign up online. For claims submitted by mail please allow additional time for return by mail.

Can I submit a past claim?

Claims can be submitted within 1 year, as long as you were a Health Plus client at the time of the expense. The exception is your travel coverage. If possible, call before receiving treatment or within 48 hours. The number is listed on the back of your ID card.

My payment information has changed, where can I update it?

Contact your Health Plus advisor and we will update your information.

Where can I find my Health Plus ID number?

Your Health Plus ID number is located on your ID card, which was included in your Welcome Kit.

I lost my ID card. How can I get a new one?

We get it, it happens. Contact us, and we can order you a new one. It may take a few weeks to arrive. You can continue using all services in the meantime and submit claims online, through the mobile app or using the forms found below. If you forget your ID number, we can provide that for you too. A digital copy of your ID card is also available in the MDM mobile app.

How do I add/remove someone from my Health Plus plan?

To add or remove someone from your plan call your Health Plus advisor at 877-218-0394. Any new plan members will need to submit an application.

My contact information or name has changed. How can I update it?

Call us to change any information such as name, address, or other contact information.

Does Health Plus include life or disability insurance?

No, it is not included in your Health Plus plan. However, we can definitely provide great options for life and disability that we’d be happy to review with you.

What other types of insurance do you offer?

We are a full-service broker and provide great options for life, group, disability, critical illness and long-term care insurance.

My professional association doesn't offer health insurance yet. Who should I talk to about Health Plus?

You can apply for Health Plus on your own. If you would like to encourage your association to offer Health Plus to members, contact us at info@healthplusinsurance.ca or 877-218-0394. You can find some of the benefits of Health Plus for Associations on our Association page.

Where can I find information on Coronavirus (COVID-19)?

For general information on COVID-19, including symptoms, government response, and social distancing guidelines, visit the Ontario government (or your local or provincial government or health authority), Health Canada, or the World Health Organization.

What resources are available to me, my family and my business to help through this crisis?

Your Health Plus plan includes access to a variety of Wellness Resources at no extra charge. Your LifeWorks Employee Assistance Program (EAP) provides online resources for managing stress, staying healthy, dealing with financial concerns and more. If you are feeling undue anxiety or distress you can speak directly with a highly trained counsellor 24/7.

More information on all the Wellness Resources included in your plan and how to access them are available below.

Information on Canada's Economic Response Plan, including support available to individuals and businesses is available online.

How does COVID-19 affect my travel health coverage?

Health Plus plan members will continue to receive out-of-country emergency medical coverage as outlined in the benefits booklet. However, we do caution that the ongoing COVID-19 pandemic may affect access to services, including immediate medical care and transportation home in the event of a covered medical emergency while travelling. We strongly urge you to follow the government of Canada travel guidelines. Current government advisories can be found online.

Will I still be able to submit claims?

You can continue to submit your claims as usual. For the fastest processing we recommend using the online claims portal or submitting through the MDM mobile app.

For more information on claims, see the How to Claim guide below.

Are your offices open? How can I contact you about my insurance?

While our team has transitioned to working remotely, we’re still here if you need us. If you have any questions you can continue to reach us by e-mail (info@healthplusinsurance.ca) or phone (416-498-6944).

Discover the Health Plus Blog

Our take on useful information about insurance and good health for you and your business. Because sometimes neither are simple.

5 Questions to Ask When You Shop for Health Insurance

Why do insurance companies ask health questions?

Wellness Moment: How to Avoid Burnout

Didn't find what you were looking for? Get in touch

Phone

416-498-6944

877-218-0394