Even More Health Plus Plan Updates For You

At Health Plus our goal is to provide the best health and dental plans to small business owners and freelancers. That means continually looking for ways to offer more coverage and working to keep rates low. We know the past two years have brought a whole new range of challenges for all Canadians, particularly small businesses. Your insurance plans should help you lead a healthy life through the ups and downs.

Current News ...

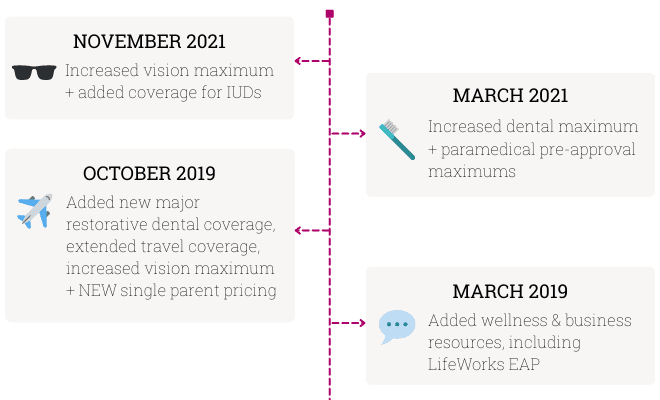

We're happy to announce that effective December 1st, 2021, we've increased the Vision maximum (OPTIMUM plan) for eye exams from $50 to $75 every 2 years. We've also added coverage in both our PRIORITY and OPTIMUM plans for Intrauterine Devices (IUDs) as a form of contraception. This change was prompted by a client request and brings coverage in line with the health needs of Canadians.

Keeping Your Rates Low ...

We are extremely proud that, as other insurance companies have increased rates, we have kept our plan rates the same. In fact, we have never raised our rates, something no other insurer can say. We also continue to offer the same low pricing at all ages.

A Look Back ...

As we mentioned, making the plan better for our members has always been important to us. Updates in the last few years include adding an Employee Assistance Plan (EAP), coverage for Major Restorative Dental, increasing dental coverage maximums, extending travel emergency health coverage and lowering rates for single parents.

Wellness is Always a Priority ...

Health is more than just visits to the dentist. It's also about your mental health, emotional wellbeing, and financial wellness. We are committed to making wellness a part of our everyday lives. That's why we include free wellness benefits for our plan members and offer regular Wellness Moments on our blog and social media. And, wellness stays top of mind as we continue to build our plans.