How to get the best value when you shop for health insurance

Shopping for health insurance isn't anyone's idea of a good time but it is part of a smart financial plan. It allows for one monthly budgetable bill that covers both routine health expenses and protection in case of unforeseen expenses from illness or injury. Because as much as we like to think we're invincible, we're probably not. But, how do you choose a plan that offers the best bang for your buck? When it comes to insurance, it's not just the sticker price (or overall monthly premium) that you should look at. You also want to know what you're getting for your money. Here are 4 factors to help evaluate a plan when shopping around to get the best value health insurance.

Overall Maximums

This is the most straightforward. It refers to the maximum coverage amount for each type of service. Pay attention to whether a plan offers a separate maximum for each service or a combined maximum for a group of services. Maximums are often on an annual basis, but can be longer or shorter depending on the service. Some plans also include overall lifetime maximums or the total amount you can claim the entire time you are on the plan.

I'm sure you've already figured out that in general, higher maximums are better. But, remember to consider not only maximums for services you may already be using (e.g. your dental visits) but all maximums weighed against real world costs. Most of us hope to never need expensive medication but a high prescription drug maximum is still a good idea. With the development of new groundbreaking medication, drug prices are on the rise. More than 1 in 100 Canadians will require prescription medication costing more than $10 000 per year, not something you want to pay out-of-pocket.

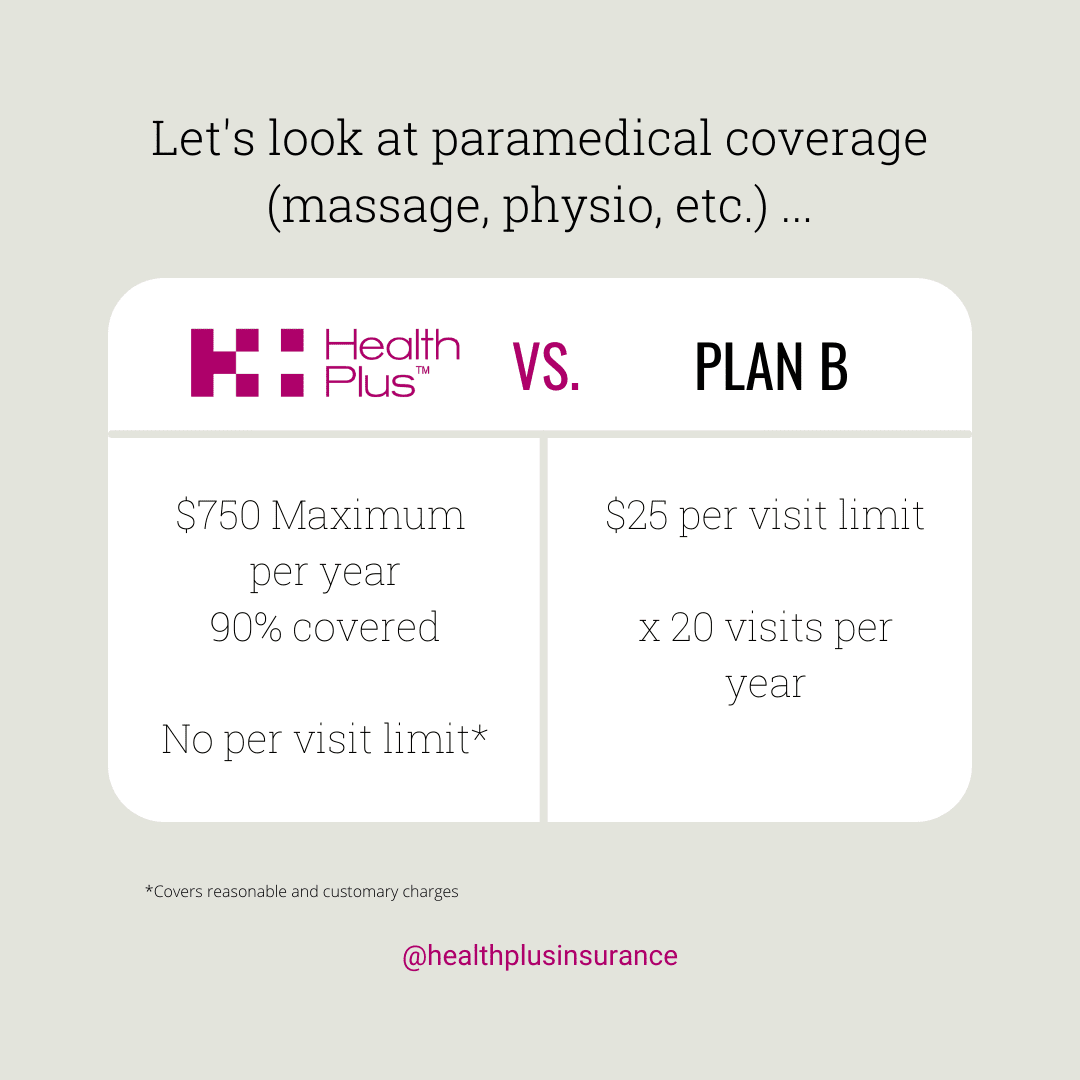

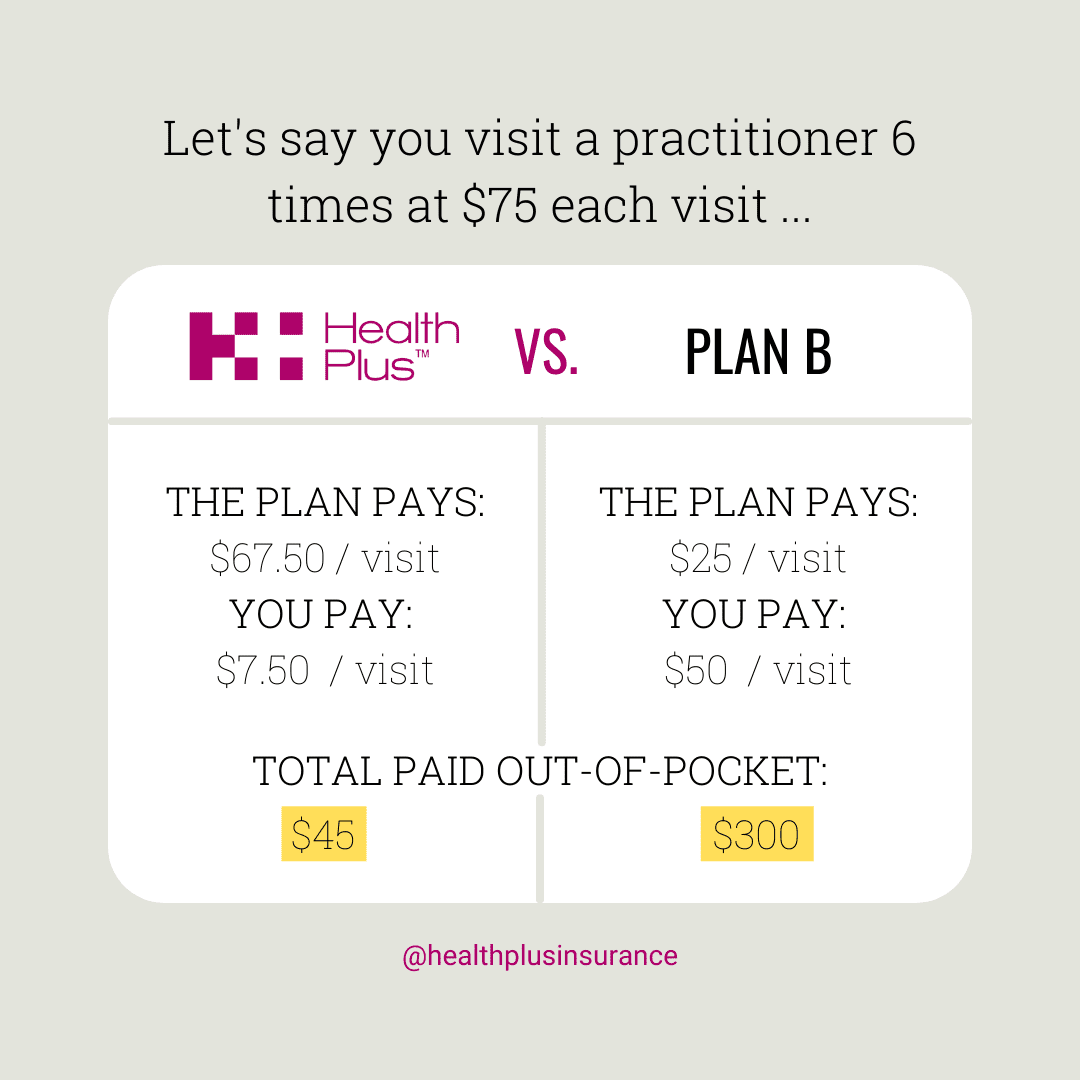

Per-visit Maximums

A lot of insurance companies also choose to limit the amount covered for one visit to a practitioner, even before you reach you reach your overall maximum. They do this so they can control claims expenditures. Low per-visit maximums can mean you end up paying a lot of out pocket for a covered service. For example, if your plan has an overall maximum of $500 for paramedical services such as massage therapy or chiropractors but a $25 per-visit limit you'll pay the difference every time you go. Obviously most professional services don't cost just $25, so this isn't too great of a deal.

You may see the words "reasonable and customary" in a policy instead. This is just the insurance company's way of saying they'll cover your treatment up to a set amount, meant to reflect the typical cost of a service. Some plans, like Health Plus plans, require an approval step for services beyond a dollar limit instead of placing a low per-visit limit. While the initial step of getting approval may seem annoying, ultimately it means if you need it you're covered. Our advice is to avoid plans with low per-visit maximums. When you're already paying high premiums they aren't good value.

Reimbursement Levels

Just because something is included in the plan doesn't mean the insurance company is covering 100%. The reimbursement level, also known as co-pay is the percentage of a claim, up to the maximum, the insurance company will pay. Plans vary widely. While some pay 50%, others pay 90%. This consideration goes hand in hand with maximums. A plan that pays 100% isn't worth much if low per-visit limits mean you'll be paying out-of-pocket regardless.

Rate Increases

This is an important one and not usually highlighted in the brochures. Plan rates may increase over time due to factors such as increasing healthcare costs or an increase may be written into your terms. For example, most plans have an automatic increase with age (Health Plus plans don't). This means every 5 years, after age 40 or 45, your monthly premium will automatically go up, something you'll definitely want to budget for. While no plan can guarantee its rates will never rise, you can try to choose a plan with relatively stable rates. And as you work health insurance into your budget it's a good idea to gauge how much of an increase you might be facing. Don't be afraid to ask whether premiums were recently increased and whether another increase is expected.

Health insurance is not an insignificant purchase. Making sure you get a plan where your money goes the farthest and you have the security you need is important. A little extra research beyond the basics and marketing slogans can go a long way. Whether you're working with a broker to help navigate the options available to you or going to companies directly, asking questions and knowing exactly what you're getting for your money will help you feel more confident in your decision.